In what can be termed as a milestone in the e-banking scenario in India, the Unified Interface app on mobile that can provide access to multiple bank accounts of a customer on a single mobile platform has gone live.

The scheme has been credited as an achievement of the outgoing RBI Governor Mr Raghuram Rajan.

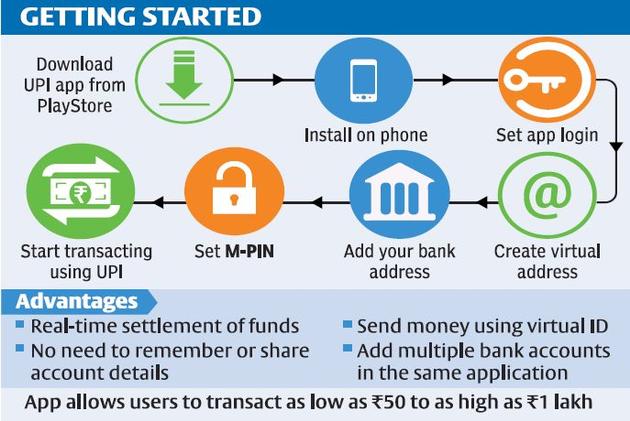

The essence of the scheme is that a customer of any Bank can download one mobile app from any of the participating Banks and use it as a gateway to all his Bank accounts. (if his Bank is participating in the scheme). He can also create an alias address such as abc@….bank. Then this ID can be used for sending and receiving money.

There is no doubt that the scheme brings in convenience to the current operations of the e-banking and mobile banking and would be welcome by many.

We have highlighted some of the risks in the past such as

a) Registration of a person’s name by another leading to consumer confusion and wrong debits or credits.

b) Fraudulent linking of accounts to cloned SIM cards

c) Fraudulent pulling of payments from the account

The registrant has been provided the option to impose restrictions in the form of time and amount limits. These may limit the fraudulent use of the registered account. But it is not clear if the fraudulent registration itself is adequately protected.

We need to watch how the system functions in the next few days to assess the security risks in greater detail. I invite the views of others on this matter.

Naavi

Related Articles:

The Hindu: UPI just turned your phone into a bank ::

NDTV Profit: Unified Payments Interface Goes Live: Here Is Your 10-Point Guide

Naavi.org, Unified Payment Interface introduced… New Threats unleashed… and

Unified Payment Interface makes Mobile a better tool for financial frauds