The petitioners who are challenging DPDPA in Supreme Court have one specific demand that they should be provided exemption from the provisions of DPDPA.

If we go through the petition of the Reporter’s Collective, it provides an elaborate argument why the Act should be scrapped because it does not provide exemption to journalists.

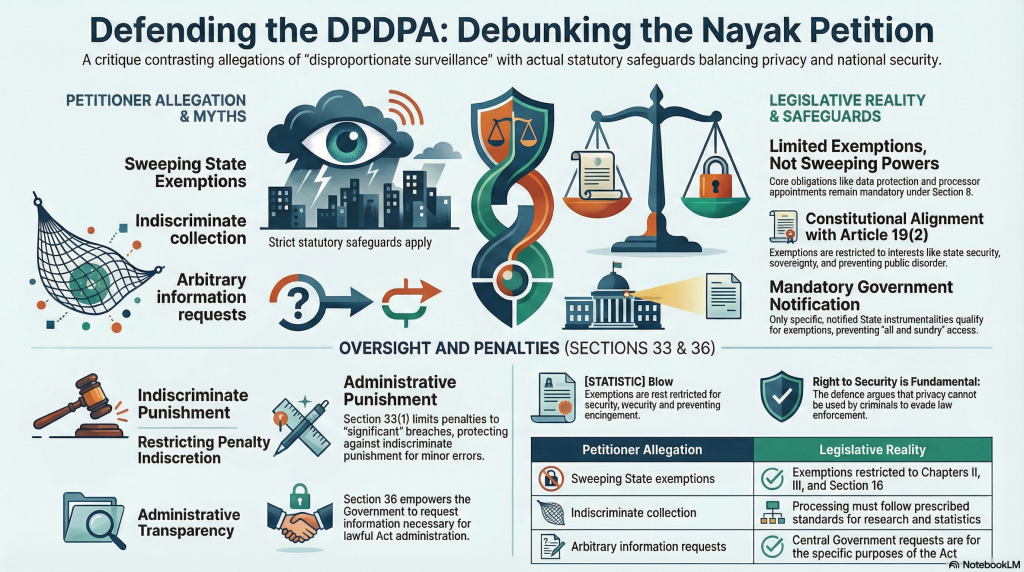

The petition however acknowledges that there is exemption for “Research” but it concludes that this does not apply to Journalistic research. the petition also acknowledges that the Government has powers to exempt any class of data fiduciaries or data from any of the provisions of the Act under Section 17(5) but contends that this cannot be applied to journalists. Hence the only remedy they suggest is to declare the Act and the Rules as Void. The petitioner has not provided any suggestions on how their concern can be remedied without scrapping the law itself.

The demand is arbitrary and indicates a malicious intention to stop the progressive legislation.

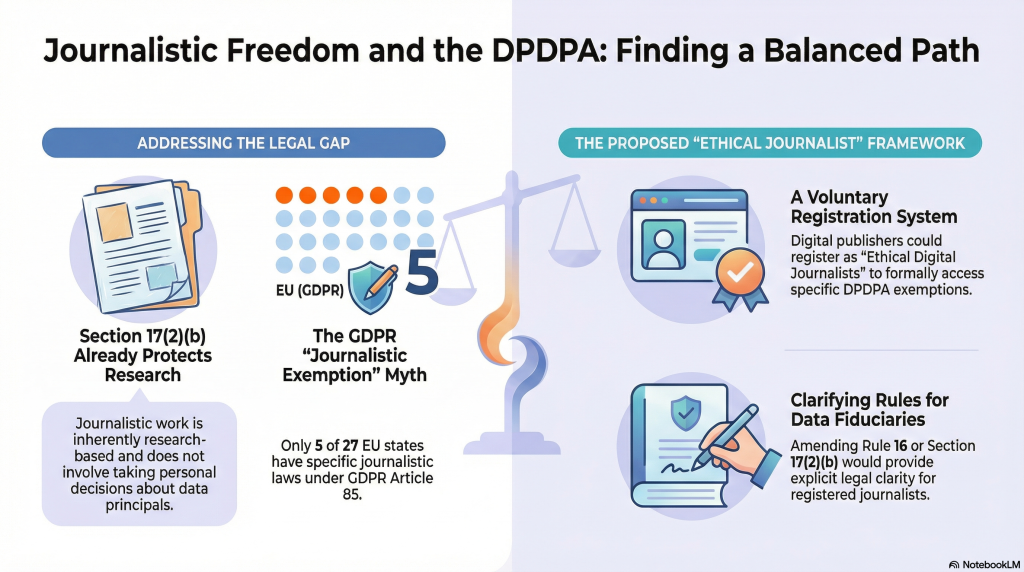

The petitioners try to project GDPR as a reference to state that exemptions for Journalists are adopted in EU. This is an incomplete statement which is meant to mislead the Court.

Article 85 of GDPR, states as follows

Article 85: Processing and freedom of expression and information

1. Member States shall by law reconcile the right to the protection of personal data pursuant to this Regulation with the right to freedom of expression and information, including processing for journalistic purposes and the purposes of academic, artistic or literary expression.

2. For processing carried out for journalistic purposes or the purpose of academic artistic or literary expression, Member States shall provide for exemptions or derogations from Chapter II (principles), Chapter III (rights of the data subject), Chapter IV (controller and processor), Chapter V (transfer of personal data to third countries or international organizations), Chapter VI (independent supervisory authorities), Chapter VII (cooperation and consistency) and Chapter IX (specific data processing situations) if they are necessary to reconcile the right to the protection of personal data with the freedom of expression and information.

3. Each Member State shall notify to the Commission the provisions of its law which it has adopted pursuant to paragraph 2 and, without delay, any subsequent amendment law or amendment affecting them.

We should note that GDPR only empowers the member states to follow their own laws related to journalists. As of date, it appears that only the following States have specific laws made in this regard.

-

-

Austria

-

Belgium

-

Bulgaria

-

Cyprus

-

Czech Republic

-

This means that there are other 22 States of the EU which have not followed Article 85 of GDPR.

In most countries exemptions are provided on a case to case basis and with certain eligibility criteria such as “Registered Journalists”.

Are the petitioners ready for the Government or DPB to introduce a “Registration System”? for Journalists to be exempted from DPDPA?

It would not be a bad idea to introduce a registration system for all “Digital Journalists” who want to be provided a recognition with an exemption from DPDPA.

We remember that Mr Kapil Sibal himself when he was the Minister in the Government of India had suggested that all bloggers should be registered with the Government.

Some time back the MeitY had introduced self regulation of digital media and had proposed online registration of digital publishers.

This system can now be pursued and registered Digital Publishers including Youtube bloggers can be given an option to register as “Ethical Digital Journalists” who will abide by certain rules and can also avail the exemptions from certain provisions of DPDPA for their journalistic research and publication.

What is required is to add an explanation to the Section Rule 16 of DPDPA Rules-Nov 13, (Second schedule) or add an additional rule for Section 17(2)(b) and make it applicable only to registered journalists.

Section 17(2)(b) which states:

The provisions of this Act shall not apply in respect of the processing of personal data—necessary for research, archiving or statistical purposes if the personal data is not to be used to take any decision specific to a Data Principal and such processing is carried on in accordance with such standards as may be prescribed.

Since a journalist does not take any decision about the data principal, his research confined to journalism is already exempted under this section. Whether the research is a fact finding research or an investigative research or a RTI research, as long as the intention is limited to “Research” this section is a sufficient protection to journalism.

Hence there is no reason to tamper with the law any further.

Naavi

Refer:

(Please refer to the views of Naavi in 2004 on registration of Blog owners)