(This is a continuation of the previous article on this subject in the series)

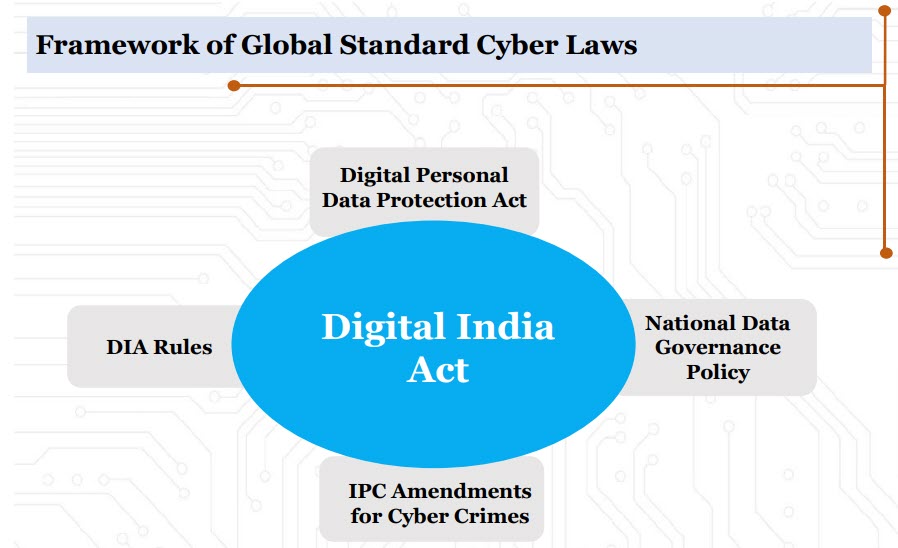

The DIA as proposed by the MeitY is proposed to replace the current ITA 2000. The structure of the new Act may see deletion of Chapter XII on Cyber Crimes, (moving it to IPC), strengthening of Chapter IX (with changes in the grievance redressal mechanism), introduction of a new chapter on monetization and also an elaborate chapter on Intermediaries and New Technology regulation.

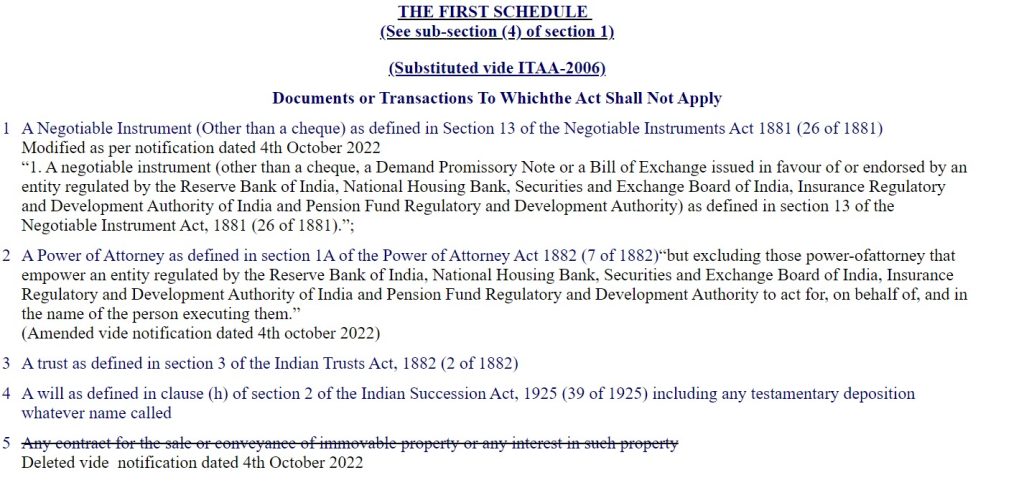

Presently the indication is also available that Schedule I which provides that certain types of documents are exempted from the provisions of the Act may be completely discarded. Recently in one of the amendments on October 4th, 2022, the immovable property related documents such as sale deeds, partition deeds, lease agreements etc which in electronic form were hitherto not recognized, have now been removed from the negative list. As a result, there can be an electronic sale deed of an immovable properties. We have already highlighted that this would increase the Cyber Crimes in India substantially and open up the real estate sector for more frauds and litigation.

At present “Will” is still in the negative list and perhaps will be the next casualty even before the DIA is introduced since DPDPB 2022 has introduced a “Nomination” facility for personal data. While we have advocated that “Nomination” of personal data may be effected using a written instrument without violating ITA 2000, it is likely that industry may force the Government to bring an amendment to the Schedule 1 of ITA 2000 and removal of item 4. This will also open up new Cyber Crimes involving deceased persons and their assets by creating fake electronic Wills.

Though the control for Fake real estate transfer documents as well as Fake Wills lies in the mandatory registration of documents, increased corruption in the state registration departments will corrupt the entire system of immovable property registrations and inheritance of properties.

We had in the distant past argued that Cyber matrimony comes with its own risks. (Refer this article Should Cyber Marriages be Banned-May 1 2005). We can add the risks of false divorce petitions springing up and very soon we will see new cyber crimes where people may allege that they are married with a subject victim, sue for divorce and extort money. If the Supreme Court goes ahead and approves same sex marriage, then such fraudsters need not always be of the opposite sex and the scope for such “Fake Marriage and Divorce” petitions would also increase.

The October 4, 2022 amendment of Schedule 1 has also made changes to Items 1 and 2 of the Schedule related to Negotiable Instruments (Other than cheque) and Power of Attorney and introduced a strange exception to the exception stating that when a Bill of Exchange or Promissory Note or a Power of Attorney document is executed or by certain designated institutions (RBI, NHB,SEBI, IRDAI, PRF) they become valid as electronic documents. These institutions will have a magic wand to even bring otherwise non recognized electronic documents of such nature by adding their endorsement or by being a beneficiary.

What has been left untouched in this negative list is only the Trust deed and it will not be long before this also is removed.

Thus in the coming days we can expect that the entire Schedule 1 associated with Section 1(4) of ITA 2000 may be deleted from ITA 2000.

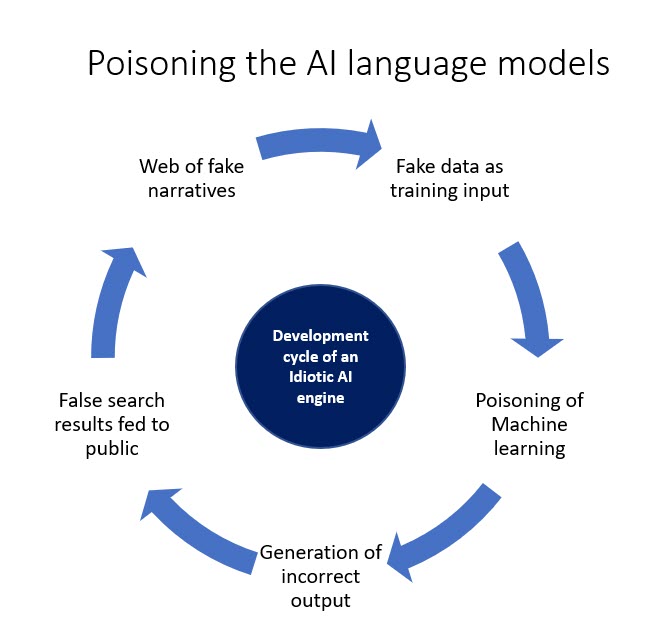

These changes will make it easy for Cyber Criminals to design new Cyber Crimes and challenge the law enforcement agencies.

As the responsibility for interpreting an incident as a Cyber Crime and preventing or prosecuting such crimes may get transferred to the Ministry of Home Affairs, the MeitY would be happy to get rid of the complaints that may arise out of such increased Cyber Crime occurences.

With the additional protection that the Cyber Criminals will get through the DPDPB 2022 and perhaps the re-introduction of the “Right to Forget”, Convicted Criminals, Accused as well as Hackers can demand that law shall protect their personal data and cover their criminal tracks. This will be like the Kashmiri Terrorists seeking protection of the Supreme Court under Indian Constitution though they have no respect for the Indian Constitution.

The move of removing the negative list therefore comes with increased Cyber Crime risks for the society. It is unlikely that this increased risk will be countered with the increased safety and security within DIA or the amendments to IPC since the objective of DIA would be promoting the new technology innovations and not creating a safe Cyber Society.

With increased demand for “De-Criminalization” of most crimes and the Supreme Court becoming more criminal and terrorist friendly than every before holding the human rights of criminals ahead of the security rights of honest citizens, the future could be a bed of thorns for the “Digital Nagariks”. (I called them Netizens in the year 2000 and now they have got a new name).

The law makers and the Supreme Court only recognize the Right to life with liberty in the form of Privacy. But neither of them have recognized the “Right to life” as a “Right to live peacefully” without terrorism and crimes jeopardizing the freedom of life.

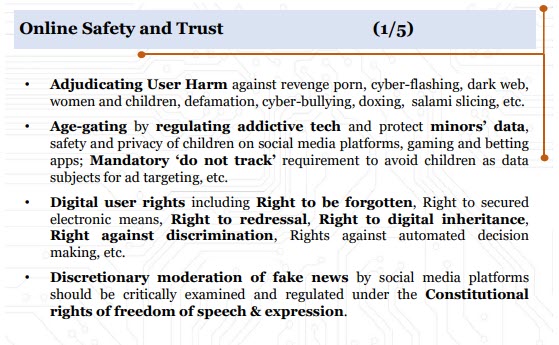

The DIA as proposed focusses more on the “Adjudication” and imposing financial penalties and is unlikely to even include the offences as part of the Act as indicated by the following propositions.

People like Naavi are well aware of how the Adjudication System under ITA 2000 which was run by the IT Secretaries who were part of the larger community of MeitY was completely ineffective. Now more reliance is being placed on the same ineffective system. We shall separately discuss the improvements that can be made in the Adjudication system in a subsequent article.

But we can flag the risk that by removing the negative list, by decriminalizing ITA 2000, the DIA will make the life of Digital Nagariks more risky than what it is now .

Naavi