This is a continuation of the previous article “The Great Data Robbery in India…64 crore data sets…weaponized for the next election...”

We have seen many data breaches from Hospitals. Banks, Payment Gateways etc. Most of these are targeted at financial crimes and result in ransomware attacks or direct phishing attacks. But what has been unearthed now in Cyberabad appears different. This data heist is not limited to financial objectives.

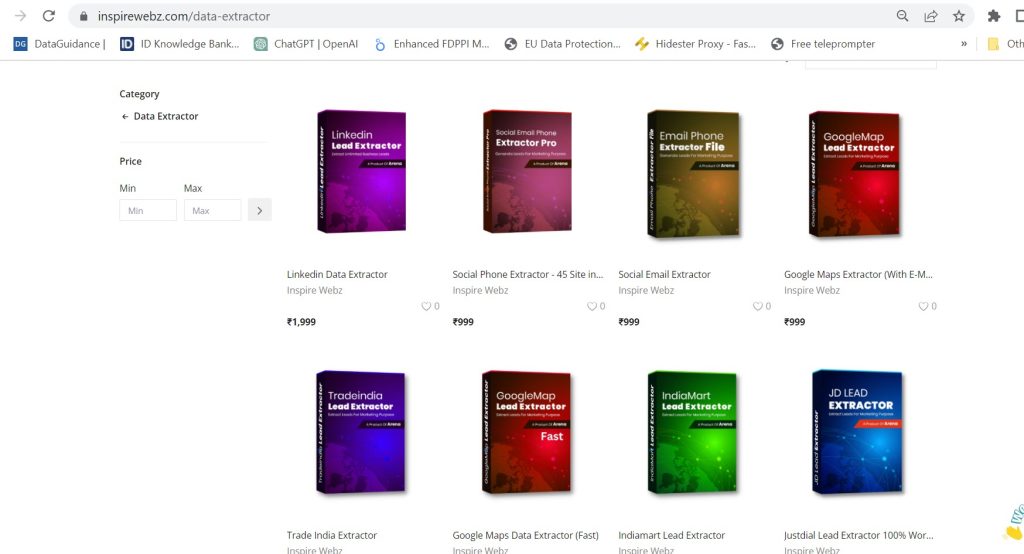

The classification of the data into different categories is really intriguing and raises alarm. The catch has been of a person who is said to be operating through a website “InspireWebz”.

We can stumble upon www.inspirewebz.com which is a website which is marketing several “Data Extractor Softwares”. Whether the arrested person is a user of this these tools or the owner of this website is not known. But the data extractor tools marketed in this website are clearly tools that can be used to commit what a data protection law would consider as “Objectionable Extraction”.

We are aware that DPDPB 2022 considers extraction of data from publicly available data space does not require specific consent. However, systematic marketing of these tools is facilitating criminals and hence the website should be considered as part of a “Conspiracy” to commit Cyber Crimes.

From the initial indications, the person arrested by Cyberabad police could have bought all the available tools in this website and later filtered and classified the data into different categories.

The press report referred to in the earlier article lists about 109 categories besides 25 state categories.

| 26. Job Seekers Database | 40 lakhs |

| 27. Domain Whois Database | 3.47 crore |

| 28. Schools, Colleges, Universities & Education 50000 | 4.2 lakhs |

| 29. Teachers Database | 5.7 lakhs |

| 30. Advocates & Lawyers | 1.64 lakhs |

| 31. Agents | 28000 |

| 32. Apparel & Garments | 65200 |

| 33. Architect & Interior Designers | 65000 |

| 34. Beauty Parlors, Hair Cutting Saloons & SPA | 70000 |

| 35. BPO Call Center Employees | 2.6 lakhs |

| 36. Building Material & Requisites | 15500 |

| 37. Business Analyst | 25000 |

| 38. Business Development & Sales Professionals | 1.5 lakhs |

| 39. Cab Users | 1.84 lakhs |

| 40. CBSE School Email IDs | 18000 |

| 41. Cell Phones & Accessories Shops | 13600 |

| 42. CEO, CFO, CTO, CMO | 2 lakhs |

| 43. Channel Sales Persons Database | 50000 |

| 44. Chartered Account | 42000 |

| 45. Chemical Pharma Companies Database | 39000 |

| 46. Chemists Dtababase | 1.23 lakhs |

| 47. Chief Managers | 20800 |

| 48. Civil Engineer | 2.53 lakhs |

| 49. Club Mahindra | 3.26 lakhs |

| 50. Commercial & Residential Properties | 29000 |

| 51. Company MD, Secretatiaty & Chairmen Database | 5.2 lakhs |

| 52. Company Proprietors Database | 3.9 lakhs |

| 53. Computer Laptop Dealers Database | 17000 |

| 54. Computer, IT & Telecom Services | 54000 |

| 55. Consultants & Consulting Services Database | 2.04 lakhs |

| 56. Contractors Database | 10900 |

| 57. Credit Card Holders 3000000 | 98 lakhs |

| 58. CRM, Call Centres BPO Executives Database | 1.2 lakhs |

| 59. Dealers Database | 20000 |

| 60. Debit Card Holders | 8.1 lakhs |

| 61. Defence Force Delhi NCR Database | 2.55 lakhs |

| 62. Designers Database | 50000 |

| 63. Digital Photography Studios Database | 58000 |

| 64. Dining Leisure Customers Database | 24000 |

| 65. D-Mat Account Holders | 35 lakhs |

| 66. DTP Operators Database | 14000 |

| 67. Economic Analysts Database | 13500 |

| 68. Educational Institutes Database | 11100 |

| 69. Electricals Electronics Stores Database | 1.5 lakhs |

| 70. Employees Delhi NCR Bank Database | 34000 |

| 71. Energy Power Sector Delhi NCR Database | 23600 |

| 72. Female Consumer Bangalore Database | 1.17 lakhs |

| 73. Financial Analysts Managers Industry Database | 1.04 lakhs |

| 74. Food Beverage Stores Database | 31000 |

| 75. Freelancers 76000 | 76000 |

| 76. Frequent Flyer 1.60 Lac | 18 lakhs |

| 77. Furniture Furnishing Business Database | 27000 |

| 78. Gas Petroleum Database | 1.03 lakhs |

| 79. Gems Jewellery Shops Database | 34000 |

| 80. General Managers Database | 14.6 lakhs |

| 81. Government Employes 110000 | 11 lakhs |

| 82. Graphic Designers Database | 48000 |

| 83. Gymnasiums 24000 | 24000 |

| 84. Health Beauty Shops Business Database (1) | 54000 |

| 85. HNI & High Income Employee 5 Lac | 5 lakhs |

| 86. Home, Garden Pets Suppliers Database | 29000 |

| 87. Hotels, Restuarants, Restro Bars, Outlet 2 Lac | 2 lakhs |

| 88. HR – Human Resources Database | 38500 |

| 89. Importers Database | 1.06 lakhs |

| 90. IT Companies Database | 39000 |

| 91. IT Professionals, Hardware Networking Working Employees Database | 15 lakhs |

| 92. Jewellers Database | 14800 |

| 93. Lecturer Professor Database | 25000 |

| 94. Legal Firms Database | 11455 |

| 95. LIC Agents Emails Database | 10962 |

| 96. Logistics Management Service Providers Database | 87653 |

| 97. Industrial Equipments Machinery Suppliers Database | 52000 |

| 98. Male Gents Database | 22 lakhs |

| 99. Manufacturing Companies Database | 1.6 lakhs |

| 100. Metals Minerals Industries Database | 15850 |

| 101.MLM Leader Emails Database | 1.12 lakhs |

| 102. Mobile Number Database | 3 crores |

| 103.NGO Trusts Database | 22034 |

| 104.NRI (non Resident Indians) 126633 | 1.26 lakhs |

| 105.OLX 1500000 | 15 lakhs |

| 106 Pancard Holder 1500000 | 15 lakhs |

| 107. Photographers Database | 28000 |

| 108. Placement Agencies Database | 48300 |

| 109. Policy Bazaar Database | 7.8 lakhs |

| 110. Principals Database | 14180 |

| 111. Printing Packaging Companies Database | 43408 |

| 112. Project Leader Managers Database | 32000 |

| 113. Purchase Procurement Heads Database | 47125 |

| 114. Purchase Managers Database | 67638 |

| 115. Real Esate Industry Database | 4 lakhs |

| 116. Recruitment Agencies Database | 49900 |

| 117. Religares Database | 4.13 lakhs |

| 118. Retail Shops 35000 | 35000 |

| 119. Samaj Community Wise 2 Crore | 2 crores |

| 120. Semi Government Industries Database | 19340 |

| 121. Senior Citizens 2000000 | 10.6 lakhs |

| 122. Services Industries Database | 1.88 lakhs |

| 123. Shopping Malls, Firms Shops Database | 81441 |

| 124. Software Engineers Database | 2.7 lakhs |

| 125. Steel Steel Products Industries Database | 1.17 lakhs |

| 126. Stock Broking Trading Companies Database | 2.06 lakhs |

| 127. Stock Traders 700000 | 7 lakhs |

| 128.CBSE Students data (10th & 12th Class) | 30 Lakh |

| 129.BYJUS & VEDANTU database | 18 lakhs |

| 130. STUDENTS Database | 2 crores |

| 131.NEET STUDENTS Database | 1.8 lakhs |

| 132.9th & 10th STUDENTS Database | 1.5 crores |

| 133. NRI Database | 1.2 lakhs |

| 134.Facebook And Instagram Groups Database | 800 |

The classifications state wise had the following information.

| State/ City Wise | Total Count |

| 1.WEST BENGAL | 70 Lakh |

| 2.UTTAR PRADESH | 21.39 Crore |

| 3.TAMILNADU | 1.02 Crore |

| 4.RAJASTHAN | 2 Crore |

| 5.PUNJAB | 1.5 Crore |

| 6.PUNE | 12 Lakh |

| 7.ODISSA | 30 Lakh |

| 8.NORTH EAST | 60 Lakh |

| 9.MUMBAI | 46 Lakh |

| 10MAHARASHTRA | 4.50 Crore |

| 11.MADHYA PRADESH | 1.10 Crore |

| 12.KOLKATTA | 46 Lakh |

| 13.KERALA | 1.57 Crore |

| 14.KARNATAKA | 2 Crore |

| 15.JAMMU & KASHMIR | 25 Lakh |

| 16.JAIPUR | 68 Lakh |

| 17.HYDERABAD | 56 Lakh |

| 18.HARYANA | 1 Crore |

| 19.DELHI NCR | 20 Lakh |

| 20.DELHI | 2.70 Crore |

| 21.CHENNAI | 70 Lakh |

| 22.BIHAR | 1 Crore |

| 23.BANGLORE | 60 Lakh |

| 24.ASSAM | 90 Lakh |

| 25.ANDHRA PRADESH | 2.10 Crore |

| Total | 48.4 CR |

The state-wide classification read along with the profession wise classification indicate multiple mis-use possibilities.

It could be used for all types of Cyber Crimes and also for structured AI assisted communication including sending deep fake videos to influence the free choice of the public during the next elections on the lines of what Cambridge Analytica was accused of.

It is time for data protection and cyber security community to debate how this threat should be viewed. Is it a simple cyber crime? or Cyber Terrorism?. Is it only an “Attempt” or an “Executed crime”? What are the labilities of all those who might have purchased the different packs of software? How have they used it? By this time all buyers should have been raided by NIA and records should have been collected on their activities.

Naavi