India is in the midst of a major overhaul as to the Privacy and Data Protection legislation. After 5 years of uncertainty the DPDPA has finally been enacted.

However we all know that due to the unreasonable and often politically motivated opposition, the law had to be repeatedly re-drafted. Now we have a law that is simple and difficult to be challenged.

Current Challenges are limited to why Privacy is given a priority over RTI? Why the DPB is not constituted by the Leader of Opposition?. Some are asking why non digital information not included? Why CJI is not the head of DPB? Why Government has to have power to make rules and not me? etc. These are great questions to ask but most of the objections are without substance and donot answer the question …How long we need to delay the passing of the law till a consensus is arrived at which the nay-sayers are determined not to allow.

Hence Government has passed the law in its present form and will issue notifications to provide more clarity. The GDPR fans will realize that despite a 99 article law in a society with a long history of Privacy legislations, EDPB guidelines and earlier WP guidelines continue to come out as subordinate legislation. Hence our law with a simpler construction will also need to be supplemented with subordinated legislation.

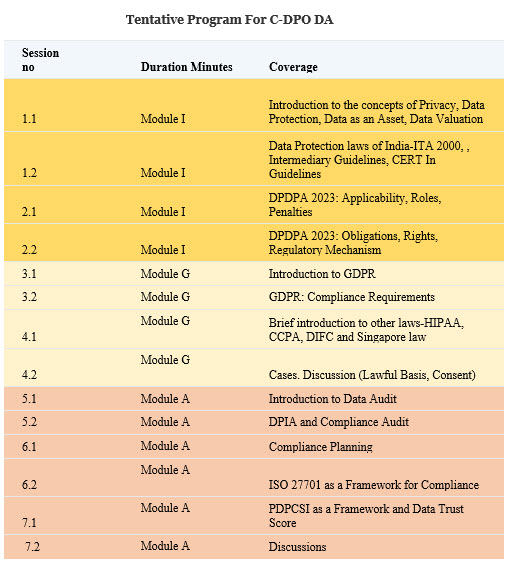

Recognizing this, FDPPI has designed all its Certification Courses with a guarantee of providing one major update after 3 months on whatever notifications come through and bring the certified professionals into a close group to continue their education through self learning with weekly knowledge sessions.

Thus FDPPI programs are future proof.

It may sound crazy that when FDPPI recently launched its new DPDPA based CDPP trainings, it offered it’s earlier certified members a complete remission of their earlier fee provided they join the new training. Though new trainings were at a higher price, the discounts were huge enough to call it commercially unwise and unnecessary.

As an NGO committed to the Data Protection Industry, FDPPI/Naavi wants every person who undergoes FDPPI certifications to feel that he/she has received value for money several times over. Fortunately this has not been difficult since the others have voluntarily placed themselves at a range where comparison is meaningless.

Quality or Price, FDPPI Certifications are the Gold Standard for the industry and will continue to be so…. This will be the Mission of FDPPI and Naavi

Naavi