Yesterday, Mr Anil Rachamalla, Founder of www.endnowfoundation.org addressed the members of FDPPI.in on Social Media Crimes and shard the details of the yeoman service he has been rendering to the community.

I invite visitors to naavi.org to check out www.endnowfoundation.org and participate in the activities of the organization.

The presentation made by Mr Anil Rachamalla is available here:

Additionally, I would like the visitors to a research report from the Future Crime Research Foundation about the nature of Cyber Crimes presently affecting our country.

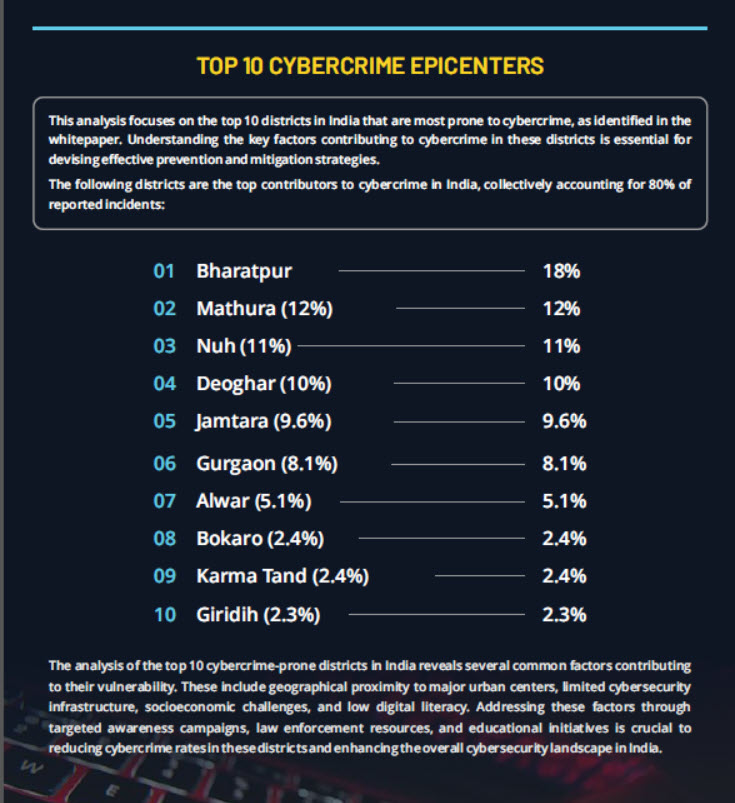

In these discussions we speak of the emergence of Cyber Crime hubs in the country.

We also know that there is the “Deep Web” which is nothing but a Cyber Crime adda.

While all of us have spent years in creating awareness about Cyber Crimes, it surprises me that there is no seriousness with the Government in tackling Cyber Crimes.

MeiTy has made the laws way back in 2000 through ITA 2000 and fortified it with amendments in 2008. This law has a clause called “Cyber Terrorism” under Section 66F.

Unfortunately the activities of the entire villages developing into Cyber Crime hubs has not been recognized by the Ministry of Home Affairs as an activity of terror against the Country.

I have been from time to time bringing similar incidents to CERT In and MeitY and even in cases of attacks on Government Property, MeitY is not willing to even file an FIR if not under Section 66F, under Section 66.

I consider this as a serious dereliction of duty on the part of the officials of MeitY. Keeping quiet when cyber crimes are being committed is a passive assistance to the crime.

In the historic Umashankar Vs ICICI Bank case, the TDSAT declared that “Not placing adequate security measures” is a passive assistance to the commission of a crime under Section 43(g) of ITA 2000 read with Section 66.

I allege that CERT In and MeitY on several occasions are guilty of such forbearance. It is time for NGOs like Anil Rachamalla to question this attitude of Meity which is nothing different from the attitude of the Courts on Urban Naxalites and Teesta Setalvad type of law breakers. Our honourable Chief Justice allegedly takes time to come out of a dance concert to set up a late evening bench one after another to hear the bail petition of Ms Teesta Setalvad during Court holidays and ensures that she gets immediate bail and then forgets the case for month. The same supreme court reserved the judgement in the case of late J Jayalalitha and allow the judgement to lapse after her death. Similar things we can expect in many current cases where influential accused are standing trial at Supreme Court. This is an indication to the public that justice in India is selective. The people of Jamtara et al are the new breed of such privileged criminals.

The same attitude percolates with sections of the Government which donot take action when required in the face of the raising Cyber Crimes and await a disaster to happen before running around.

I have recently sent some emails to the Secretary MeitY, DG-CERT In with copies to Mr Rajeev Chandrashekar and awaiting response for one such cases. I am not sure of their response because Government thinks that people who fight to change the system are fools and they donot know how to flow with the tide. Instead of complaining against organized Crimes, if Naavi or Anil Rachamalla compromises on principles , we can be more prosperous than fighting against Crime and against Criminals who retaliate in different forms.

If researchers can identify towns which are epicenters of crimes, we need to simply take an army of CRPF to cleanse the towns of these Cyber Criminals. We need to close down all bank branches in these towns since these Banks are facilitators of crime, close down all SIM card sellers since MSPs are also facilitators of crime. We need to ensure that these epi centers should be converted into deserts of information at least until the responsible elders of the town try to discipline the society.

Does Mr Amit Shah has the guts to take on these Cyber Criminals? Does MeitY has the intention of acting against such crimes?

If not, the selfless services of persons like Endnowfoundation or Future Crime Research Foundation or Naavi.org will go waste. When I look back and see that I spent 14 years pursuing the Umashankar Vs ICICI Bank case, I feel that the justice delivery system in the Country requires a major overhaul.

I am aware that there are heros in Police such as Dr Triveni Singh who have been tirelessly working on mitigating Cyber Crime incidents. But we need at least one Dr Triveni Singh for every district in the country and an army of Triveni Singhs for the epicenters mentioned above.

I invite all interested persons to join Naavi,org this October 17, the Digital Society Day 2023 which we try to remember each year because ITA 2000 became a law in this day in 2000 and undertake a pledge to find solutions to Cyber Crimes. The days of creating awareness is over. The time is to fight back with criminals.

I liked Anil Rachamalla’s call “Be an Upstander…not a Bystander” . I echo these words against MHA, MeitY and CERT IN also.

Please write back to me through email if you want to participate in the activities of Naavi.org on October 17, 2023.

Naavi