Naavi.org has been maintaining that Bitcoins is a menace to the civilized society and India should ban it. We have given our logic through a series of articles in this site.

We have also made a note that many of the opinions expressed at My Gov.in discussion page are from persons who have no idea of what is Bitcoins and how it can damage the Indian economy but were expressing support on the site because they were plants from vested interests.

Today there was a huge surprise in store and it has to be brought to the notice of the public so that public can take their own view about the need for what kind of regulation is required to be considered by the Government of India on Bitcoins.

I would like to re-iterate that Bitcoin is the “Currency of the Criminals” and under the current legislative scenario in India it cannot be regularized either as a currency nor as a Commodity fit to be traded in a legal exchange regulated by SEBI. Bitcoin recognition in any form or even continuing the current status of “Observation” will promote Black Money and Money Laundering and the act of supporting it is itself a betrayal of the country’s interests.

Not initiating action to stop the current use of Bitcoins as a perceived “Currency” and ignoring the fact that there are exchanges which are buying and selling Bitcoins in India against Cash is a dereliction of duty on the part of regulators and the situation has to be corrected before the matter becomes a scandal in the media and attracts rebuke from the honourable Supreme Court of India.

On perusing the comments posted on the MyGov site, it was found that a comment had been posted by Multi Commodities Exchange of India Limited operating under the regulations of SEBI.

The objects clause of the Memorandum of Association of MCX India Limited states as follows

“To establish, operate, regulate, maintain and manage facilities in Mumbai and elsewhere in India and abroad enabling the members of the Exchange, their authorized agents and constituents and other participants to transact, clear and settle trades done on the Exchange in different types of contracts in commodities and other instruments and derivatives thereof, in futures markets and to provide accessibility to the markets to various members of the Exchange and their authorized agents and constituents and other participants within and/ or outside India, and to provide, initiate, facilitate and undertake all support services relating thereto as per the Articles of Association, ByeLaws, Rules and Regulations of the Exchange.”

The exchange carries the permissions from RBI and SEBI making it part of the regulatory system at present and its expression of support for legalization of Bitcoins means that the Committee of the Finance Ministry has insider interests in legalizing Bitcoins.

From a prima facie indication the Committee and collection of opinion from the public etc could be a farce and part of a conspiracy in which a decision has already been take to legalize Bitcoin.

The copy of the PDF document enclosed in the opinion is not typed on the letter head of the exchange nor is signed.

It says as follows:

QUOTE:

Multi Commodity Exchange of India Ltd

Comments/Suggestions for the Existing Virtual Currencies Framework

We propose that Bitcoin be accepted as legal financial instrument in India and the regulations be governed under a separate ‘Virtual Currency Act’. The adoption of virtual currency should be encouraged in India since Blockchain technologies are now considered to be the future of electronic financial transactions. A very strong impetus to legalize virtual currency is its potential to drastically reduce corruption, shrink transaction costs and eliminate third party involvement.

To ensure consumer protection, companies who wish to deal with Bitcoin must be subjected to stringent regulation to ensure that the virtual currencies are not being used for criminal purposes. Currently in Japan, a company wishing to use Bitcoins is required to have at least $100,000 in reserve currency, report their activities to the government regularly and undergo routine audits by the National Tax Agency. Meanwhile in Philippines, Bitcoin is largely used for remittances and payments with transaction volumes reaching up to US$6 million per month for certain major players and therefore Bitcoin companies are treated as remittance companies. That means that all requirements for remittance companies such as registration, minimum capital, internal controls, regulatory reports, and compliance with know-your-customer (KYC) and anti-money laundering (AML) policies applies to Bitcoin startups in Philippines.

Although counterfeiting of Bitcoin is not supposedly possible, extra caution should be improvised and special cyber law be drafted under Ministry of Information and Technology to protect against security breaches on the Bitcoin network. The following are some notable breaches in the past:

1. In 2013, about 850,000 Bitcoin valued at over $400 million were stolen by hackers in a service attack against the most popular Bitcoin exchange Mt. Gox, following which they declared bankruptcy.

2. In April 3, 2013, Instawallet, a web-based wallet provider, was hacked, resulting in the theft of over 35,000 Bitcoins.

To promote orderly development of VCs we propose the following measures:

1. Allowing Bitcoin exchanges to operate in India. These companies perform KYC checks and can follow anti-money laundering provisions and suspicious transaction reporting.

2. Encourage Financial Institutions, government bodies and Tech companies to use blockchain technologies.

3. Allow e-commerce companies and to accept Bitcoin as a mode of payment

Finally institution(s) like the Indian Revenue Service , Ministry of Information and Technology and Reserve Bank of India should be allowed to should monitor/ regulate the VCs.

May 31, 2017

UNQUOTE:

The recommendation is clear and advocates that “Bitcoin be accepted as legal financial instrument in India” leaving no doubt to the intentions of making the instrument called Bitcoins be available for all those who want to park their wealth anonymously so that Black Money can proliferate and Criminals can continue to demand ransom in the form of Bitcoins.

At this point of time,I am not aware if this is an official communication from MCX or the logo of MCX has been used by some mole in the organziation.

This needs to be clarified by the organization and its Directors in particular.

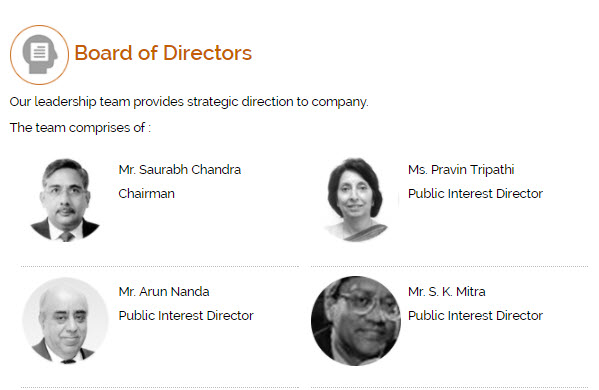

The following are the directors of MCX:

I request these august members of the Board to

a) Confirm if they are aware of the official position that MCX has taken and published even before the Committee has met to consider the public opinion

b) Give a disclaimer that as of this date they have never held, traded or benefitted from Bitcoin trading in the past

c) Confirm whether they individually endorse the opinion that Bitcoin should be legalized in India ignoring the fact that it is the preferred currency of Cyber Criminals and Cyber Financial Terrorists and could be the currency of the future for funding terrorist operations in India?

I request the Finance Minister Mr Arun Jaitely to order an enquiry on how the subordinate regulator working under RBI and SEBI has already taken a stand on legalization of Bitcoins and the entire exercise of collecting public opinion is therefore rendered as a farce.

I request the Prime Minister to take note that the attempt to legalize the Bitcoins is a betrayal of the Fight on Corruption and Black money initiated by him and there is a conspiracy that may be under hatching behind his back.

I will treat this as a public notice to all these directors and wish that they provide their views on this development immediately.

Probably Mr Subramanya Swamy and Arnab Goswami should follow up and ensure that if there is any conspiracy by MCX Exchange of India to influence the decision of the Committee, the illegality of it is brought out into the open.

I will also try to find out the e-mail contacts of these Directors and send them individual notices though it may not be strictly necessary.

P.S: If the posting of the opinion on the MyGov forum was not authorized by the Board, I expect the Board to initiate an enquiry and punish the person responsible. If an honest disclosure is made by these distinguished persons, I express my regrets that I had to bring this incident to the open.

Naavi

Pingback: MCX removes its comments… Will BSE/NSE take action for this Corporate Governance failure? | Naavi.org