Naavi/FDPPI had recently announced that we would provide a free assessment of DPDPA-2023 compliance on websites and provide an assurance tag “WEB-DTS”. However when we went through some of the requests, it was found that none of the websites met the minimum criteria for Web-DTS certification. It was a disappointment that the simple compliance requirements which should have already been in place now remained unattended.

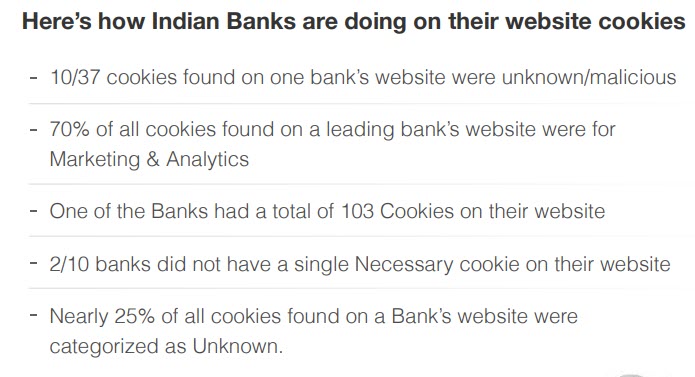

In this context, it was interesting to find from a report from an company engaged in development of compliance software that in a survey of 10 websites of top Banks, it was found that the simplest of compliance namely “Cookie Management” on the websites was found wanting. A glimpse of the findings of the cookies is indicated below.

If the most equipped organizations like Banks cannot complete the simplest of compliance requirements such as cookie management on a website, it would be an uphill task to ensure that they have to be compliant with DPDPA 2023 before the year end.

Currently FDPPI is offering DPDPA 2023 assessment service through the DGPSI framework and suggested the first step of Web-DTS for compliance of the website.

For its corporate members, FDPPI is providing some services which could include “Consent Record Management” service. The first milestone for this is the WebDTS and Cookie management. In this context the report on the current status of Cookie management in Banks is revealing.

Naavi