I have been carrying on a crusade against Private Crypto Currencies such as Bitcoin for years and if anybody can say FTX crash was natural, I have the right to say so.

Money Control today carried an article titled “FTX Collapse: RBI has the last laugh on crypto. If you ignored Das’s warnings, the joke is on you”

I would like Money Control to also refer to the many articles in Naavi.org where I have called out even Money Control for promoting Bitcoins in the past.

In my scathing attack , I have not spared any body including the media and Supreme Court.

Even today I consider Supreme Court as one of the biggest culprits for having blessed Bitcoins for reasons which only can be surmised.

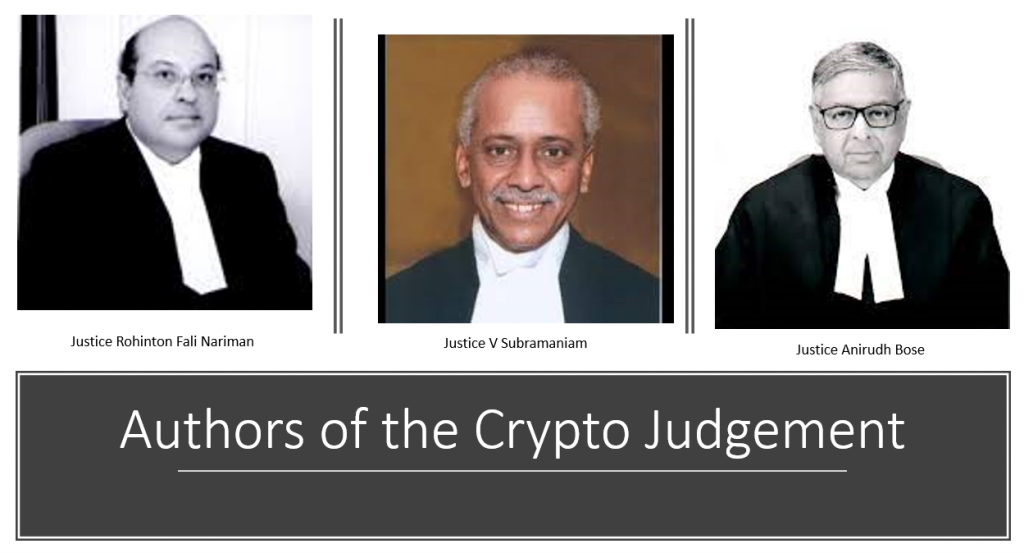

One has to read this unique judgement to understand how a clever judgement can be written stating that one side wins but the other side takes the benefit. This “Bollywood Judgement” is a museum piece of a judgement which is written like a Bollywood script with heros , villains and climax etc.

In this case where a petitioner who was a Crypto Exchange challenged the decision of the Bank to freeze the account based on the RBI circular, the Court ordered that

“RBI is obliged to direct the Central Bank of India to defreeze the account and release the funds of the petitioner together with interest at the rate applicable.”

The consequences of this judgement was terrible. Technically the Supreme Court may justify its action. But morally it gave a clean chit to the operations of the Crypto Exchanges and painted RBI as in the wrong. Since then the transactions of Bitcoin increased and many more Indian investors were caught by the bug.

The Finance Ministry right from the days of Late Mr Arun Jaitely to the current day have been in favour of Bitcoin. The MCX went to the extent of publicly supporting Bitcoin to be included in the commodity trading and had I not called out their nefarious decision aloud, they would have colluded with the finance ministry and given a commodity status to Bitcoin by this time.

It was only the resistance of RBI and frequent warnings by Mr Shakti Kant Das which held back a decision in this regard. Even now there is an attempt to sneak in the Bitcoin (and other private crypto currencies) through the amended Data Protection Law or ITA 2000. But FTX incident should put a check on this attempt.

The CBDC introduced by RBI is for a different purpose and does not amount to validation of the Crypto Currencies like Bitcoins. It may make it even more difficult for the Bit Coin lovers to get a legal approval for the “Currency of the criminals and the corrupt”

I therefore consider that the FTX incident is a welcome development that prevents more damage to our economy through the crypto currencies. While I regret the loss suffered by the innocent investors, they should have seen it coming since the entire eco system of Bitcoins was created and run by criminally minded persons who were fugitives of taxation law in their respective countries.

I had participated in the first Bitcoin conference in India and was enamoured by the technology and even stated that legally it can be acceptable in India through the ITA 2000. Even some RBI officials were present during the conference as observers. But when I tried to reason with the Bitcoin syndicate that they should align with a law compliant system, I found out that they had no intentions of working within the legal environment and it was thereafter that I started my crusade against Bitcoin.

Our war against Private Cryptos is not over until the Government comes up with a suitable legal provision to declare transactions related to Private Crypto Currencies as “Money Laundering” and start taking penal action. Now we will only be going with the presumption that Bitcoin is not legal but what we need is to treat it as a punishable crime to deal with or promote private crypto currencies in any form. Work on this is pending.

Naavi