We have discussed at length the subject of P2P lending platforms in the past and highlighted the need for proper regulation. Some of the earlier discussions can be found in the following articles.

Peer to Peer Lending Platforms and Regulatory Compliance

FinTech Companies need to watch out for the new regulations from SSWG

Will PSD2 have an impact in India?

RBI’s FinTech Working Group needs to secure Consumer interests also

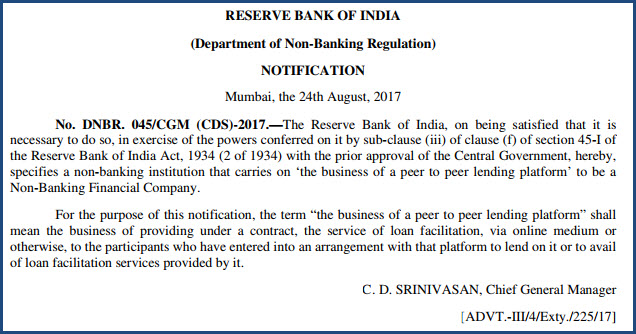

Now RBI has finally come out with a notification that P2P lending platforms will be treated as “NBFCs”. (See Report here)

According to the notification

the term “the business of a peer to peer lending platform” shall mean the business of providing under a contract, the service of loan facilitation, via online medium or otherwise, to the participants who have entered into an arrangement with that platform to lend on it or to avail of loan facilitation services provided by it.

This is the correct interpretation as otherwise there would have been chaos in the financial services industry.

The P2P lending platforms raise funds at one end and lend it at the other end. While Banks absorb the funds into their account and then lend it out of their own kitty, P2P platforms may match the buyers and lenders directly and earn commission in between.

However, in practice it would be the platform that would be guaranteeing the repayment of loan participation coupons to the suppliers of lendable resources and recover the funds from the borrowers. If this had not been regulated, there would have been scope for many scams.

Though the Fintech company’s representative publicly states that they welcome the development, it is clear that many of the companies who were planning to come out with their Start Up operations have not factored in the regulations and need to completely revamp their proposed operations.

We welcome the move of the RBI.

Naavi