Fraud or Magic at SBI Cards?

At SBI Cards some magic appears to be

happening. 2+2 is adding upto some thing different than 4 and the managers

seem to be unable to sort out why it is happening?.

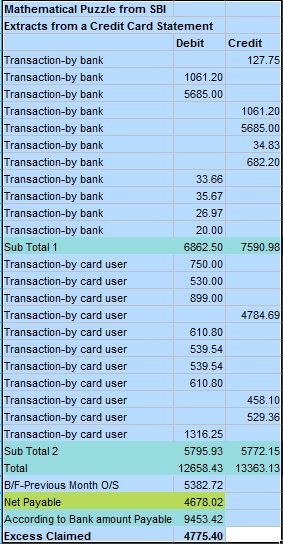

I am giving below an extract of a statement from a Card

a ccount

which shows a one month statement of expenses for April 2008

including transactions booked internally by the Bank. According to simple

arithmetic, the statement adds up to indicate a net amount payable by the

client to the extent of Rs 4678.02. However, the Bank indicates an amount

payable of Rs 9453.42.

ccount

which shows a one month statement of expenses for April 2008

including transactions booked internally by the Bank. According to simple

arithmetic, the statement adds up to indicate a net amount payable by the

client to the extent of Rs 4678.02. However, the Bank indicates an amount

payable of Rs 9453.42.

Despite being presented with this statement the

authorities at SBI Cards which is managed by GE Finance, are unable to sort

out the issue of how the statement shows an amount of RS 9453.42 payable

instead of RS 4678.02.

The matter has been reported to the Chairman of SBI as

well as the Banking Ombudsman. Their intervention has also been ignored by

the Card division.

Though it would have been possible for the Bank to

manually correct the error, there is no positive action by the SBI Card

division nor the Bank. They seem to think that if the "Computer says 2+2=5,

then it must be correct!"

The incident raises an important question whether

the customer’s money in the Bank safe? Can the shareholders of the Bank

trust the management of the Bank for safeguarding the investor’s interest?

As an Information Security observer, one of the

possibilities indicated by the incident is that the software of the card

division might have been fraudulently manipulated and at certain

conditional fulfillment, it charges customers an amount higher than what is

payable.

If the money is not payable by the customer, then where

is it being credited? Is it going to any individual in the Bank? or is the

Bank getting enriched by the software bug?

I would like to mention that this is the second incident

of software related fraudulent possibility that has been indicated by

the undersigned at SBI. Two years back I had notified the Bank that there

was an indication of a software bug in their “Senior Citizen Account

Software” and it was resulting in an excess of 16% being charged on the

expenses account in the Bank compared to whatever interest was due to be

paid to a customer. ie. For every RS 100 paid to the customer, RS 116/- was

debited to the charges account. This was based on the observation of two

accounts in one of the branches which was stated to have similar problems

in 70 more cases. I had then notified the Bank that this was indicative of

a possible fraud amounting to nearly R 8000 crores. I had also suggested

that there was a need for software audit to eliminate the problem.

(For details please read

SBI...and TCS.. owe an explanation and

SBI.. Solid Foundation is Melting )

To the best of my knowledge nothing has been

done in this regard though there was a public statement at that time from a

DGM that it was due to a software error and would be corrected from the

following accounting year.

The SBI Card incident now being reported being

the second incident in which a potential fraud in SBI has been brought to

the notice of the public, I hope that the top management of the Bank would

realise that they may be liable for negligence in not taking appropriate

action. I bring it to the notice of SBI top brass that under Section 85 of

ITA 2000, if there is any fraud in the computerized accounting in the Bank,

the liabilities under Section 66 would be vicariously carried to the

officials of SBI including the Chairman unless they demonstrate "Due

Diligence".

Now through this open forum the attention of

SBI is being drawn once again to the need for top management attention on

the matter. The matter requires an independent Source Code audit of the

Card accounting software to determine why the accounting is going wrong. In

view of the possible fraud behind this incident it is necessary for a CBI

enquiry to be ordered to make an impartial investigation.

Until then the card division should suspend

its activities.

I urge all customers of SBI cards to check their

accounts regularly, add up the card usage and check if the amount shown as

payable in the statement is correct.

I look forward to a response from SBI management in this

regard at the earliest. I also call upon RBI to respond with their view on

how to make the Ombudsman scheme effective if the Bank refuses to act on

the reference made by the Ombudsman.

Naavi

November 10, 2008